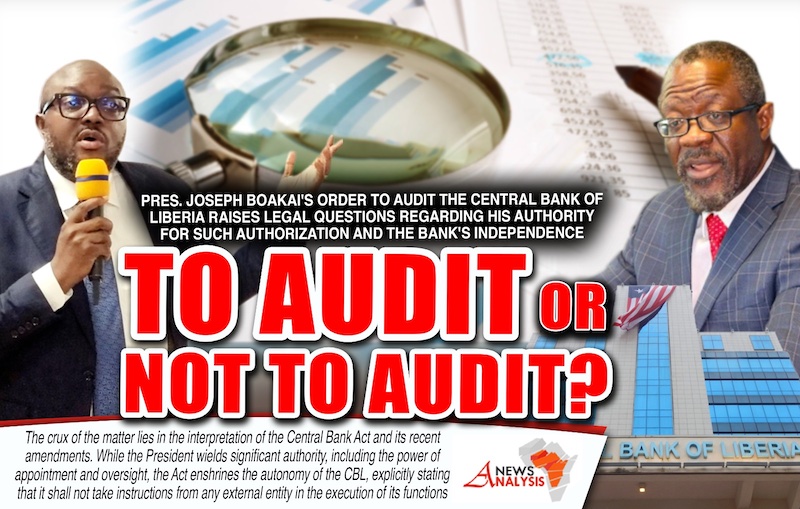

Presidential Order to Audit Liberia’s Central Bank Sparks Debate over Legal Boundaries and Bank’s Autonomy

MONROVIA – President Joseph Boakai’s mandate for the General Auditing Commissin (GAC) to audit the Central Bank of Liberia (CBL) has sparked a debate over the legality of the President’s mandate, the authority of the GAC to audit the CBL and the CBL succumbing its independence to the Executive.

Acting on President’s madate, the GAC recently dispatched an engagement letter to CBL, outlining the audit’s parameters and submitting a series of document requests to support the comprehensive audit.

Debating the Functions of the GAC

The debate surrounding the functions of the General Auditing Commission (GAC) in Liberia hinges on the interpretation of its mandate as outlined in the GAC Act, particularly in relation to Section 2.1.3 and Section 5 of the Act.

Section 2.1.3 of the GAC Act establishes the duties of the Auditor General, stating that the Auditor General shall be responsible for auditing the public accounts and public funds of Liberia. It empowers the Auditor General to carry out audits and inquiries of public entities and funds owned or controlled by the government, with the aim of enabling reporting as required by the Act. The section also grants the Auditor General the authority to determine the scope, timing, and type of audits to be conducted, emphasizing the independence of the Auditor General in performing operational duties.

However, legal proponents argue that the GAC’s authority to conduct comprehensive audits, such as the one on the Central Bank, may not be justified based on the definition of public accounts or public funds provided in Section 5 of the Act. According to Section 5, public funds or money include resources in the custody or control of the state, such as taxes, user fees, interest, dividends, proceeds from property sales, royalties, fines, grants, and debts due to the state, among others. It also establishes the Consolidated Fund as the repository for all revenues raised or received by the state, except for those specifically designated for other funds or purposes.

The contention arises from whether the Central Bank’s operations fall within the purview of “public accounts” or “public funds” as defined by the Act. While the GAC Act grants broad authority to the Auditor General to audit public entities and funds controlled by the government, the specific delineation of what constitutes public funds appears to limit the scope of the GAC’s audit jurisdiction.

The debate underscores the need for clarity in interpreting the mandate of the GAC and delineating the boundaries of its audit authority vis-à-vis the operations of entities like the Central Bank.

Acting Under Authority

Also Section 5.5 of the GAC Act outlines stringent criteria for accepting external requests for audit. The section unequivocally states that requests from entities outside the GAC should generally not be accepted, emphasizing the importance of maintaining the Commission’s autonomy. However, it makes exceptions for formal requests from members of the Legislature or the President. In such cases, the Auditor General is mandated to carefully evaluate whether the requested audit aligns with the GAC’s legal mandate and can be executed within its allocated resources.

Moreover, Section 5.5 serves as a reminder of the limitations imposed by law on the GAC’s authority.

How The CBL Is Audited

Critics argue that the President’s order contravenes the provisions of the CBL Act, which outline the CBL’s independence and its sole authority to conduct internal and external audits. Moreover, they point to specific sections within the Act that mandate regular audits by the Chief Internal Auditor of the CBL, appointment of external auditors by the Board of Governors, and oversight by an independent Audit Committee.

The Act’s provisions, including those governing audits, are designed to safeguard the CBL’s independence from undue influence or interference, including from the executive branch.

The CBL Act’s supremacy clause also stipulates that in case of conflict with other laws, the Act’s provisions relating to the CBL’s authority and monetary policies shall prevail.

Proponents of the audit argue that the President’s directive is within his constitutional powers to ensure transparency and accountability in government institutions. They contend that while the Act grants autonomy to the CBL, it does not preclude external scrutiny, especially when concerns arise regarding financial management and accountability.

Rep. Foko Calls for Clarity

Meanwhile, in a letter addressed to the Speaker of the 55th National Legislature, Hon. Frank Saah Foko, Jr., a member of the House of Representatives, has raised legal concerns regarding the President’s authority to order the GAC to conduct audits of institutions like the CBL.

The letter, dated February 24, 2024, Rep. Foko meticulously analyzed relevant legislation, including Acts pertaining to the duties and functions of the Auditor-General and the General Auditing Commission, as well as amendments to the Public Financial Management Act and the Act establishing the Central Bank of Liberia.

According to Rep. Foko’s analysis, the President lacks the legal authority to unilaterally mandate audits of institutions such as the CBL. Rep. Foko cited several sessions of the GAC and the CBL Acts.

He, therefore, indugled Speaker Fonati Koffa to invite the Legal Advisor to the President to provide clarity on the President’s request to the GAC to audit the Central Bank.